Tata Steel has today proposed a restructuring of its Long Products business to target high-value markets and introduce greater flexibility into its costs and operations. To support this strategy, Tata Steel plans to invest £400 million over a five-year period.

Significant cost savings were achieved in Long Products during the global economic downturn after a range of strategic actions were taken, including a radical restructuring of the Speciality Steels business, which is now in profit. However, the Long Products business as a whole has continued to make losses over the last two years. The decline in some major markets, particularly the construction sector, has been a key factor. Demand for structural steel in the UK is only two-thirds of the 2007 level and is not expected to fully recover within the next five years.

As a consequence the business has proposed a plan to further reduce costs, focus on products that create value and improve its ability to respond quickly to demand fluctuations. This strategy includes a proposal to close or mothball parts of the Scunthorpe plant and puts at risk 1,200 jobs at Scunthorpe and 300 jobs at its Teesside sites.

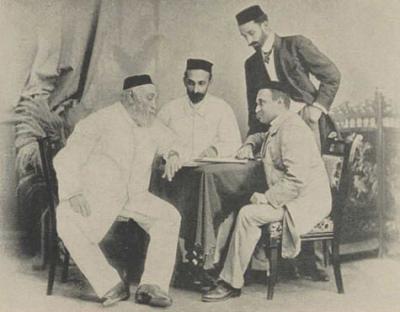

Karl-Ulrich Köhler, Managing Director and CEO of Tata Steel’s European operations, said: “We are proposing to take these actions only after going through an inclusive consultative process that involved very careful scrutiny of the Long Products business performance. We have used the experience we gained in turning around our Speciality Steels business in developing this strategy for the rest of Long Products and we are convinced it represents the best chance of making this business successful and sustainable in the long term.

“Tata Steel is showing its commitment to making this strategy work by earmarking £400 million of investment for this business over the next five years.

“At the same time we are aware that our employees and their families will experience a very unsettling few months as a result of this announcement. We will do everything we can to provide them with support and assistance.

“The continuing weakness in market conditions is one of the main reasons why we are setting out on this difficult course of action. Another is the regulatory outlook. EU carbon legislation threatens to impose huge additional costs on the steel industry. Besides, there remains a great deal of uncertainty about the level of further unilateral carbon cost rises that the UK Government is planning. These measures risk undermining our competitiveness and we must make ourselves stronger in preparation for them.”

Michael Leahy, General Secretary of Community union and Chair of the Steel Committee, said: “We are, of course, extremely disappointed at the prospect of further job losses, coming as they do on the back of earlier cutbacks. However, difficult though the current position is for all concerned, we recognise that this is part of a wider strategic review of the business aimed at securing its long-term viability and access to new markets. To that end, we welcome the commitment to invest £400m over the next five years.

“The key now is for the company to engage the local trade unions in consultation on the way forward. We will be seeking an early meeting to explore all possible means of avoiding any compulsory redundancies.”

As part of the restructuring, the business is proposing (in Scunthorpe):

- To close the Bloom and Billet Mill and associated steel caster (Bloom 750)

- To mothball the Queen Bess blast furnace, which will be kept in readiness for a market upturn

- To review the operations of the Billet Caster.

Jon Bolton, Director of Tata Steel Long Products, said: “As difficult as they are, these steps will help us to shape this business for the future. Over the longer term we will be able to re-invest in our people, our customers, our equipment and the local communities in which we operate.

“Some of our key markets are not forecast to fully recover from the global economic downturn for a number of years. Other market sectors have changed and our customers are demanding new and different products from us, as well as improved levels of service.

“This investment will improve Long Products’ manufacturing capabilities, particularly in the area of plant reliability. By closing the Bloom and Billet Mill we will be taking out of production some highly energy-intensive plant that is pretty well obsolete in today’s steelmaking world. By mothballing Queen Bess furnace we will match our operations to the new market realities, but retain the flexibility to respond to a market upturn.”

The investment follows a number of recent announcements in the business, including upgrading the rail rolling mill at Hayange in France, as well as improvements to the plate and wire rod rolling facilities in Scotland and England.

The jobs at risk are in operational, functional and management positions. A 90-day consultation process will begin soon with affected employees and union representatives.

The company will make every effort to achieve the job losses through voluntary redundancies. However, it is important that critical skills are retained enabling the business to increase output should the markets recover. A comprehensive range of redundancy packages and outplacement support services will be made available to those leaving the company. There will be full consultations with employees and their representatives throughout the process.

-ends-

For further information, please call Bob Jones on +44 (0)207 717 4532 or email bob.jones@tatasteel.com.

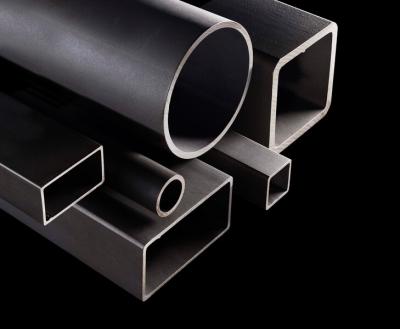

About Tata Steel in Europe

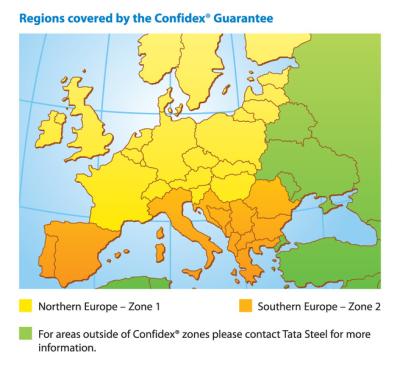

The European operations of Tata Steel (formerly known as Corus) comprise Europe's second largest steel producer. With main steelmaking operations in the UK and the Netherlands, they supply steel and related services to the construction, automotive, packaging, material handling and other demanding markets worldwide. Tata Steel is one of the world’s top ten steel producers. The combined group has an aggregate crude steel capacity of more than 28 million tonnes and approximately 80,000 employees across four continents.