A comprehensive report, launched at the recent UK Metals Expo sponsored by Tata Steel, provides a valuable snapshot of the UK metals industry, shedding light on opportunities for sustainable growth and the obstacles that must be overcome through collaboration and partnership with the government.

This essential report also delves into the critical issues currently faced by the industry. The information contained within the report has been meticulously gathered through an industry-wide survey, with insights contributed by experts and knowledgeable professionals from across the sector.

Lord Redesdale, Chair of UK Metals Expo, noted: "This is the ideal platform for launching this report, with more than 200 exhibitors and 4,000 industry professionals from 52 countries. It aligns seamlessly with the UK’s Net Zero ambitions, relying on advanced materials, manufacturing excellence, and engineering innovation."

"A robust domestic metals supply chain is pivotal to achieving our objectives, fostering energy-efficient production, nurturing circular economy practices, and propelling sustainable progress.”

While the report includes updates from a wide range of trade associations, there are some key themes running throughout, as follows:

Trade with the EU:

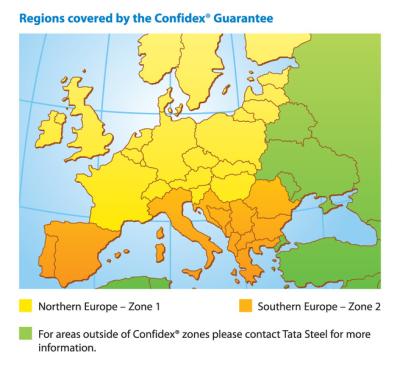

Maintaining trade relations with the European Union (EU) has become increasingly challenging for businesses in the UK. In response, companies are actively diversifying their strategies by reducing their reliance on the EU market and exploring opportunities in non-EU countries. Key findings from the report include:

- 24% of businesses have adjusted their supply strategies

- 17% have diversified their business activities

- 15% are actively seeking new international markets

The report emphasises the importance of collaboration between industry players and the government to navigate these evolving trade dynamics successfully

Raw Material Supply:

Raw material supplies pose a unique challenge due to price volatility (31%) and supply chain disruptions (21%). Mitigation measures include diversifying supply chains and sourcing regions (27%) and forming longer-term partnerships with suppliers (26%).

Key recommendations for government intervention include:

Ensuring effective protection for business energy procurement contracts

Providing access to finance for capital investments

Offering guidance and support for energy efficiency programs

Skills and Employment:

Key challenges in the sector include a limited pool of qualified candidates (26%), difficulty in attracting skilled labour (23%), and a general labour shortage (20%). To address these issues, 24% of businesses are offering competitive salary and benefits packages to retain and attract talent. The sector is eager to collaborate with the UK Government to encourage more young people to pursue careers in the industry and ensure flexible funding for upskilling opportunities, including technician-level apprenticeships.

The report underscores the importance of government collaboration in addressing these challenges and fostering sustainable growth within the UK metals industry. Government support in areas such as trade facilitation, energy efficiency, and skills development will play a pivotal role in securing the industry’s future competitiveness and its contribution to the nation’s economy.

Energy Costs:

Energy consumption is a significant cost factor for UK metals sector businesses, with 27% citing high energy consumption as a challenge. Additionally, fluctuations in energy market conditions (25%) have added complexity to operations. Key findings include:

- 23% are seeking to reduce energy consumption.

- 30% of businesses are requesting enhanced support and resources from the UK Government to navigate trade barriers and customs procedures.

- 17% want to introduce more energy-efficient processes.

The report underscores the need for government support to address these energy-related challenges effectively.

Net Zero, Circular Economy, and Competitiveness:

The UK metals industry is committed to achieving Net Zero emissions and sustainable raw material practices. However, the report highlights challenges in implementing circular economy practices, such as a lack of awareness among customers (31%) and high implementation costs (23%). Key findings include:

- 29% of businesses are focusing on raising awareness and educating customers.

- 21% are engaging in partnerships to promote circular economy practices.

With domestic competition (45%) being the primary source of competition, the industry is looking to the government for support in achieving Net Zero goals, promoting circular economy practices, and maintaining competitiveness.

The report can be downloaded here

Also, keep an eye out for the latest episode of Tata Steel UK's "Steelcast" podcast which was recorded at this year's UK Metals Expo, where we spoke to Lord Redesdale and many other speakers and contributors.