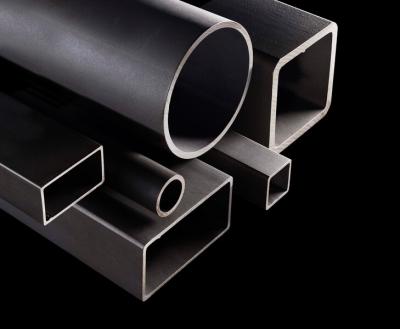

President Trump has announced he would impose 25% tariffs on steel and aluminium imports into the US on top of existing duties.

In a statement today, trade association UK Steel says:

With the President giving away few details of what he is proposing, it remains unclear whether this will cancel all or some of the previous arrangements on existing Section 232, 25% tariffs on steel and 10% tariffs on aluminium.

The UK exports around 200,000 tonnes of steel per year to the US, worth over £400m.

Certain countries like Canada and Mexico were granted exemptions when Section 232 tariffs were first imposed in 2018. Later the UK, the EU and Japan negotiated a system of tariff-rate quotas.

"The UK produces world-leading steel, supplying the US with high-quality products for defence, aerospace, stainless, and other critical sectors." Gareth Stace, UK Steel

Until now, customers in the US could also apply for product specific exemptions to import products not made in the US, tariff-free. It will be important to understand whether the recent announcement will override all these arrangements.

Any changes to current agreements between the UK and the US could have a hugely damaging impact on the UK steel sector, both directly and via trade diversion from countries that may be barred from exporting to the US.

Current global steel overcapacity means that when the US imposes tariffs on multiple countries, excess steel is forced into other markets, including the UK. Without strong trade shields, this risks a surge of unfairly priced imports, undermining UK steelmakers, distorting competition, and threatening the long-term viability of our industry. The UK is currently partially shielded from the effects of trade diversion by existing Steel Safeguard measures, but these expire in June 2026.

The UK Carbon Border Adjustment Mechanism (CBAM), a tax measure on high-emission steel imports, will not come into force until January 2027.

UK Steel Director General, Gareth Stace, said: “The imposition of US tariffs on UK steel would be a devastating blow to our industry. The US is our

second largest export market after the EU. At a time of shrinking demand and high costs, rising protectionism globally, particularly in the US, will stifle our exports and damage over £400 million worth of the steel sector’s contribution to the UK’s balance of trade.

"It is deeply disappointing if President Trump sees the need to target UK steel, given our relatively small production volumes compared to major steel nations. The UK produces world-leading steel, supplying the US with high-quality products for defence, aerospace, stainless, and other critical sectors, materials that simply cannot be replicated elsewhere.

"At a time of uncertainty for the sector, a punitive new tariff on UK steel exports would be hugely damaging and threaten jobs." Alasdair McDiarmid, Community Union

“At the same time, the introduction of further US tariffs will inevitably divert global trade flows, with excess steel potentially redirected to the UK market. This reinforces the urgent need for watertight UK trade measures in 2026 to prevent surges in imports following the UK’s steel safeguards expiry. Accelerating the UK’s CBAM to 2026 would provide an additional layer of protection against unfairly priced steel. The UK Government must act decisively to shield our domestic industry from the fallout of rising global protectionism."

Alasdair McDiarmid, Community's Assistant General Secretary, said: "While we await full details and a formal policy announcement, the comments from the White House regarding new tariffs on steel are extremely concerning.

"At a time of uncertainty for the sector, a punitive new tariff on UK steel exports would be hugely damaging and threaten jobs. For the US it would also be self-defeating, as the UK is a leading supplier of specialist steel products required by their defence and aerospace sectors.

"Again, this just reinforces the need for a strong UK Carbon Border Adjustment Mechanism and for robust new measures to be put in place when existing safeguards expire to shield our steel sector from a surge in cheap imports."

ENDS

UK exports:

The UK exported 300kt (£490M) of steel to the US in 2017 before Section 232 tariffs were imposed in 2018. The UK exported an average of 200kt (£320M) over 2018- 2021. The UK and the US agreed a system of tariff rate quotas in 2022 seeing exports recover slightly to 235kt (£517M). However, the next two years have seen a tough market for steel as a result of high costs and weak demand, which has impacted UK steel production and exports. In 2023, the UK’s steel exports to the US totalled 165kt (£388M).

Global excess capacity:

Global excess capacity was estimated at 543Mt in 2023 and is forecasted to reach 630Mt by 2026 – equivalent more than 100x the UK’s production.

Capacity expansions in Southeast Asia and the Middle East are continuing at an alarming rate – these are largely state-funded, mostly for high-emission blast furnaces and often do not correspond to domestic demand trends. Indeed, steel demand is weakening in key markets, notably China, translating into rising oversupply which is dampening steel prices and spilling over into other markets.

So far this year alone, steel imports into the UK have increased by 17% year-on-year amid a weak demand environment. The import share in 2024 has jumped to 70%, from 60% in 2023 and 55% in 2022. The sharpest import increases have come from non-EU sources, mainly India, Vietnam, China, South Korea, Turkey and Algeria. Importantly, these are also countries that have seen significant increases in imports from China or are within China’s top 10 exporting destinations.

Over two thirds of steelmaking capacity is in countries that have Net Zero targets later than 2060 or none at all.

What are safeguards?

Safeguards are a type of trade remedies measure intended to address unexpected surges in imports that are damaging or threatening to damage domestic producers. Safeguards can take various forms but the most common is a tariff-free quota – this allows the continuation of tariff-free imports at the same level or higher as the period before the safeguard was introduced.

UK CBAM:

The UK Carbon Border Adjustment Mechanism (CBAM) is a tax policy designed to prevent carbon leakage by applying a carbon cost to certain imported goods, including steel, based on their embedded emissions. It should ensure that overseas producers face similar carbon costs to UK manufacturers, creating a level playing field and supporting the UK’s decarbonisation efforts. By aligning import standards with domestic climate policies, the UK CBAM should help protect British industry from unfair competition while driving global emissions reductions. However, UK Steel and others have voiced significant concerns about the robustness of the UK CBAM, as current design suggests importers are prioritised over domestic producers.

The UK steel sector:

Produces 5.6Mt of crude steel a year, equivalent to 70% of the UK’s annual requirement (annual demand of 7.6Mt in 2023, of which 40% was met by domestically produced steel)

Employs 33,700 people directly in the UK and supports a further 42,000 in supply chains

The median steel sector salary is £37,315, 26% higher than the UK national median and 35% higher than the regional median in Wales, Yorkshire, and Humberside, where its jobs are concentrated

Directly contributes £1.8 billion to UK GVA and supports a further £2.4 billion

Directly contributes £3.4 billion to the UK’s balance of trade 96% of steel used in construction and infrastructure in the UK is recovered and recycled to be used again and again.

Follow us on social media